From our early beginnings, one of the primary tools the Agency has used to help co-ops improve their operations is their risk rating.

Essentially, a risk rating identifies a co-op’s current degree of health and its future prospects, based on evaluations of its financial strength, operational performance and the physical condition of its property. Our guidance and support over the years have focused on moving the risk profile of our clients from a higher to a lower risk of falling into difficulty.

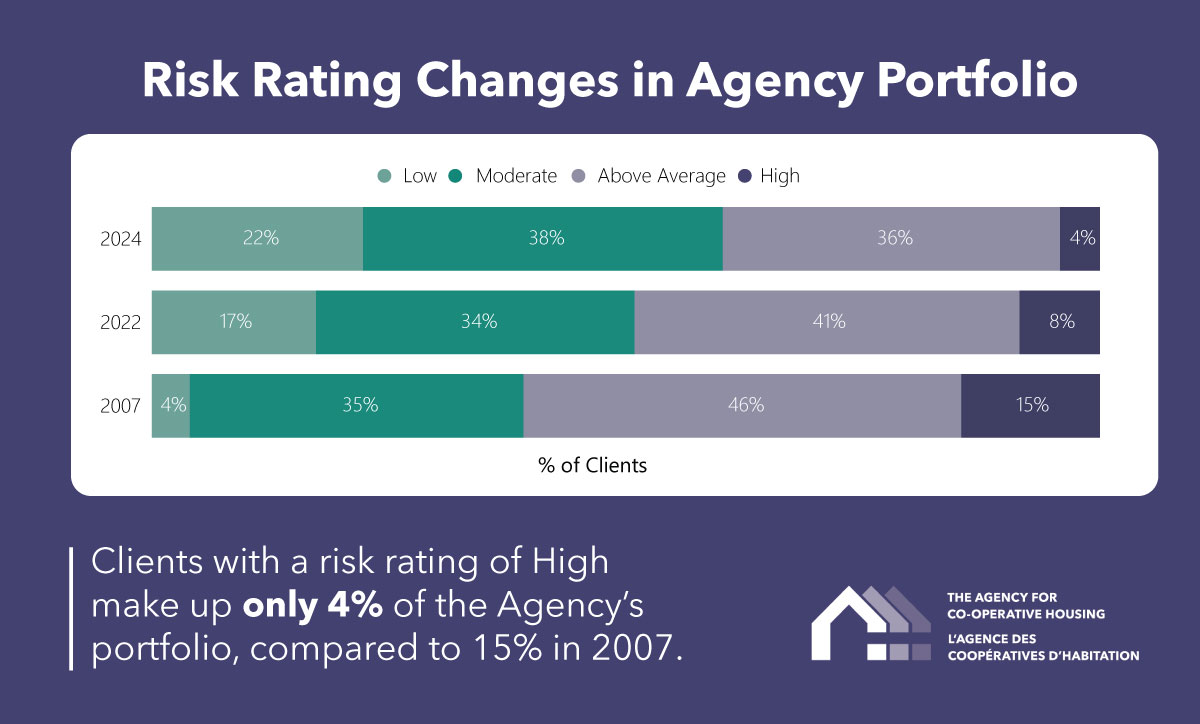

In our 2024 Portfolio Performance Report, we looked back to 2007 to see how our clients’ ratings have changed over time. Encouragingly, housing co-ops in our portfolio have made great progress.

Back in 2007, 15 per cent of clients had a risk rating of High. That has dropped to only four per cent as of 2024, with 60 per cent now having a risk rating of Low or Moderate. While 40 per cent of co-ops in our portfolio still have a risk rating of Above Average or High, it’s important to remember the context that many housing co-ops are operating in today.

Most of our client co-operatives have now paid off their original mortgage. While you might assume that, being debt-free, they would see a significant improvement in their risk profiles, the story is more nuanced.

More than half of the co-ops with expired operating agreements have taken on new financing to fund necessary capital repairs and renew their properties. The result is that savings on the original mortgage are now being directed toward new loan payments, with correspondingly higher interest rates than most co-ops paid on their CMHC direct loans.

The main drivers of risk among the Agency’s client co-ops are these new debt-servicing costs and housing charges not keeping up with expenses.

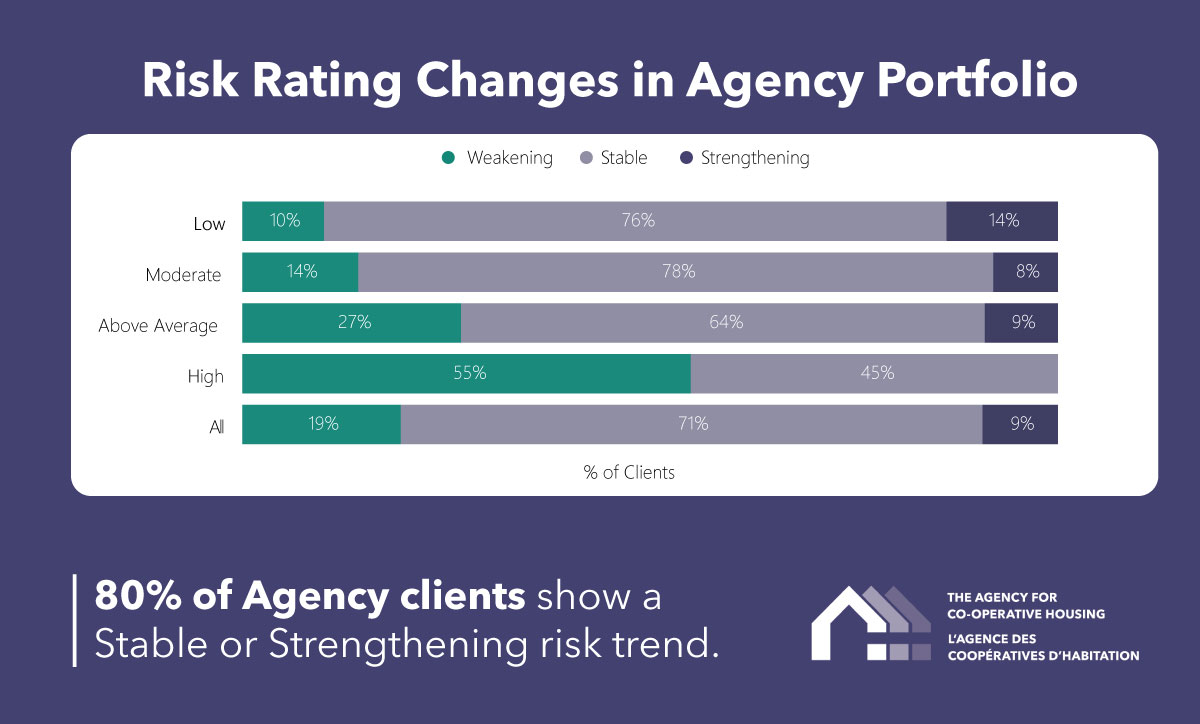

However, even though risk is sticky, we continue to see co-ops on a path to improvement. During our annual risk-rating process, we assign co-ops a risk trend of Strengthening, Stable or Weakening. Encouragingly, 80 per cent of our clients received a risk trend of Stable or Strengthening.

For co-ops with a Low risk rating, a Stable trend generally means that building conditions and finances are in a good place, and the co-op is being proactive at facing up to any issues. Conversely, a Weakening trend for co-ops with a High or Above Average risk rating means that they are moving in the wrong direction and need to change course by addressing the issues we’ve identified.

The purpose of a co-op’s Risk Rating is to alert board members to potential risks confronting their operations. While challenges remain, we’re pleased to see how many co‑ops have taken it upon themselves to improve their rating and reach a stable plateau.

Learn more about the metrics we track and how we use them to improve co-op performance in our 2024 Portfolio Performance Report.