Each year Canada Mortgage and Housing Corporation (CMHC) produces rental-market reports for many parts of Canada. These reports are an in-depth look at the trends Canadians can expect to see in rental housing. Because CMHC’s rental-market reports for January 2020 covered only major cities, we asked Will Dunning, an economist specializing in market analysis, to take a close look at provincial trends. Here’s what he told us.

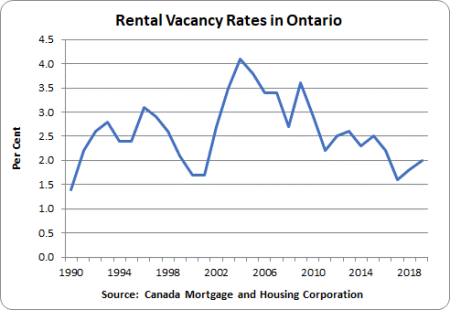

Ontario

Ontario’s vacancy rate rose to 2.0 % in October 2019 from 1.8 % a year earlier. Clearly, more rental housing is needed to meet the needs of a population growing by 1.8 % versus a long-term average of 1.2 %. On the other hand, landlords’ aggressive rent increases have acted to stifle some of the demand that we would expect to see for rental housing.

Statistical analysis for Ontario shows that the vacancy rate for a “balanced market” would be in the area of three %. Chronically low vacancy rates have allowed rents to rise, in real terms, by a significant average of 1.0 % each year during the past 29 years, and even more rapidly during the past three years. (In 2019 CMHC estimates that rents increased by 6.1 %.) In the current environment, Ontario’s rents will likely continue to rise quite rapidly.

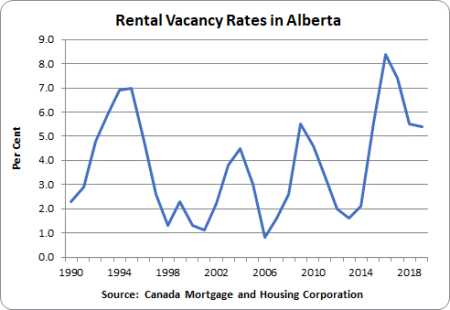

Alberta

Alberta’s vacancy rate is still retreating from the extraordinary peak it reached in 2016. The October 2019 rate of 5.4 % was fractionally lower than the 5.5 % rate we saw a year earlier. The falling vacancy rate has been due to slight higher employment levels, moderately strong population growth (currently 1.7 % versus a long-term average of 1.9 %) and a drop in housing construction. For now, new housing supply and demand are roughly in balance.

CMHC estimates that in 2019 Alberta rents increased by 1.3 %. Statistical analysis for Alberta indicates that the vacancy rate for a “balanced market” would be in the area of 4.5 %. With actual vacancies well above that threshold in recent times, “real” rents have slipped down, to some extent, from the very high levels seen a few years ago. However, even with these recent adjustments, during the past 29 years real rents have increased by an average of 0.8 % a year. With continued high vacancy rates, Alberta’s rents are likely to see only moderate increases.

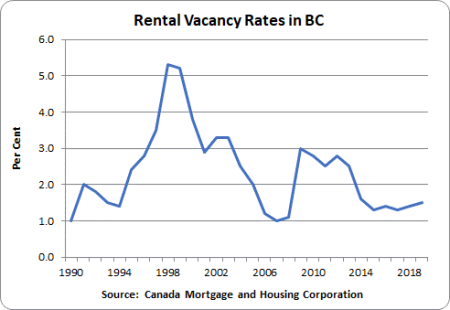

British Columbia

As of October 2019, British Columbia’s vacancy rate had increased slightly to 1.5 % from 1.4 % a year earlier, but remains very low. This small reduction is due to increased production of new housing largely offset by moderately strong population growth (1.6 % versus a long-term average of 1.5 %). Currently, new housing supply and demand are roughly in balance, but more housing construction is needed to ease chronic shortages.

CMHC estimates that BC rents increased by 4.2 % in 2019. Statistical analysis for BC shows that the vacancy rate for a “balanced market” would be in the area of three to 3.5 %. With actual vacancies well below that threshold most of the time, “real” rents have increased by the substantial average of 1.2 % a year during the past 29 years. With housing production now more or less matched with the increasing need, shortages will persist, resulting in continued rapid growth in rents.

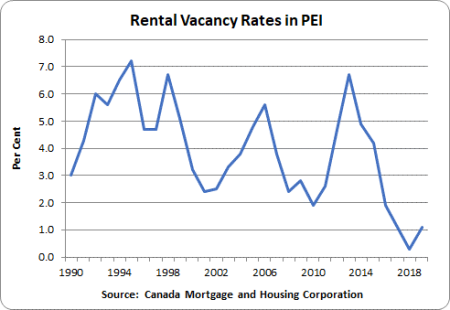

Prince Edward Island

Prince Edward Island is experiencing extremely low vacancy rates. The rate of 1.1 % for October 2019 was higher than a year earlier (0.3%), but is still evidence of a severe housing shortage. Low vacancy rates have been due to a combination of much more rapid population growth (currently 1.8 % versus a long-term average of 0.7 %) and housing production that has not kept up with the demand.

CMHC estimates that rents increased by 2.7 % in 2019. Statistical analysis for Prince Edward Island (PEI) indicates that the vacancy rate for a “balanced market” would be in the area of 3.5 to four %. (At that level, we would expect rents to rise by two per cent a year). PEI’s vacancy rates have usually been high enough to keep rents flat—or even falling—in “real” (inflation-adjusted) dollars. However, with the vacancy rate now far below that threshold, the province will almost certainly continue to see rapid rental increases.

Want to find detailed data on your city? Check out CMHC’s report database here. As always, follow the Agency on LinkedIn, Facebook and Twitter for all things co-op!