Each year Canada Mortgage and Housing Corporation (CMHC) produces rental-market reports for many parts of Canada. These reports are an in-depth look at the trends Canadians can expect to see in rental housing. We asked Will Dunning, an economist specializing in market analysis, to take a close look at provincial trends. Here’s what he told us.

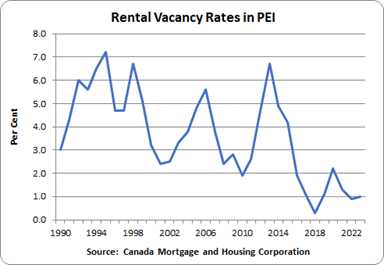

Prince Edward Island continues to experience extremely low vacancy rates. The rate for October 2023 was 1.1 per cent, little changed from 0.9 per cent a year ago. This vacancy rate is for purpose-built rental apartments and town homes. Statistical analysis for PEI indicates that the “balanced market” vacancy rate is about 3.5 to four per cent. (This is the vacancy rate at which we would expect rents to rise by two per cent per year—vacancy rates below this threshold are likely to result in rapid rent increases.) The PEI vacancy rate is lower than that for all of Canada (1.5%). Low vacancy rates have resulted from a combination of rapid population growth (currently estimated at 4.0 per cent versus a long-term average of 0.9 per cent) and housing production that has not kept up with the need.

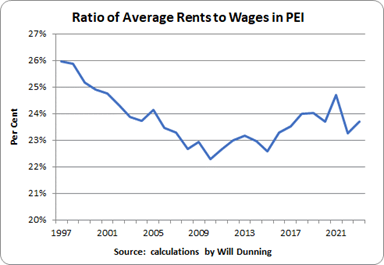

CMHC estimates that rents increased by 2.3 per cent in 2019. (This is the slowest rate among the 10 provinces.) The average rent for all apartments and town homes (all bedroom types) in the province was $1,079 this year. During the past three years, the provincial average rent has fallen slightly in real (inflation-adjusted) terms. The ratio of average rents to monthly wages within PEI rose during 2023, but it is still moderate in historic terms, and in comparison to other provinces. During the near future, persistently low vacancy rates may cause rents to continue rising in real terms and relative to incomes.

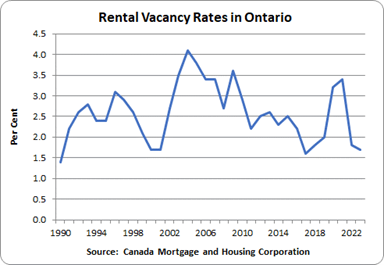

Ontario’s vacancy rate (for apartments and town homes) fell fractionally, to 1.7 per cent in October 2023 from 1.8 per cent a year earlier. A bit surprisingly, the rate didn’t fall by very much, considering the intense pressures from population growth (currently 3.4 per cent versus a long-term average of 1.3 per cent) and inadequate volumes of housing production. On the other hand, landlords have been raising rents very aggressively, and this may be suppressing new household formation and demand for rentals.

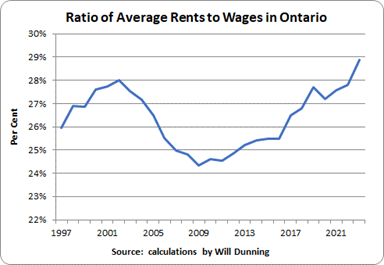

Statistical analysis for Ontario indicates that the “balanced market” vacancy rate is about 3 per cent. Current vacancies indicate a highly pressured market. CMHC estimates that rents increased by 8.1 per cent in 2023. The average rent (for all unit types) was $1,609. Chronically low vacancy rates have allowed rents to increase significantly in real terms, and in relation to wage rates. The ratio of average rents to average weekly wages has increased sharply during the past decade and is now at the highest level seen in the history of these data. With low vacancy rates likely to persist, Ontario’s rents will likely continue to rise in inflation-adjusted terms and relative to incomes.

In Toronto CMA, the 2023 vacancy rate was 1.4 per cent and the estimated constant sample rent increase was 9.1 per cent. The average rent (for all types of units) was $1,830. For Ottawa CMA, the vacancy rate was 2.2 per cent and the rent increase was 4.3 per cent. The average rent was $1,553.

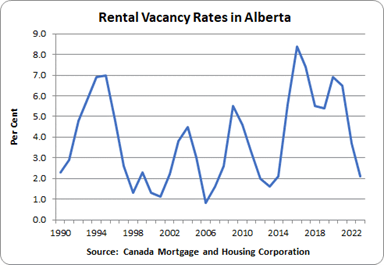

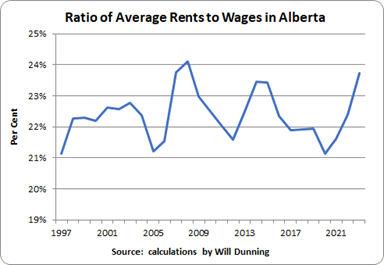

Alberta’s rental market has shifted rapidly from high vacancy rates to low rates. The October 2023 rate (for apartments and town homes) was 2.1 per cent (versus 3.7 per cent a year ago), which is now far below the balanced market threshold, which is estimated at about 4.5 per cent. With current vacancy rates far below this, the rental market is highly pressured. The sharp drop in the vacancy rate has resulted chiefly from very rapid population growth (4.3 per cent during the past year, versus a long-term average of 1.9 per cent). Housing production has not kept up with the pressures that result from population growth.

During the past three years, the increasingly tight rental market has allowed the average rent in Alberta to increase more rapidly than wages. Consequently, the ratio of rents to wages is now at one of the highest levels seen in the history of this dataset. CMHC estimates that rents increased by 9.1 per cent in 2023. The average rent (for all unit types) was $1,368. With low vacancy rates likely to persist, Alberta’s rents will probably continue to rise in inflation-adjusted terms and relative to incomes.

In Calgary CMA, the 2023 vacancy rate was 1.4 per cent and the estimated constant sample rent increase was 14.4 per cent. The average rent (for all unit types) was $1,583. For Edmonton CMA, the vacancy rate was 2.3 per cent and the rent increase was 6.1 per cent. The average rent was $1,292.

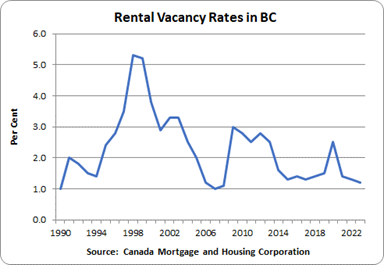

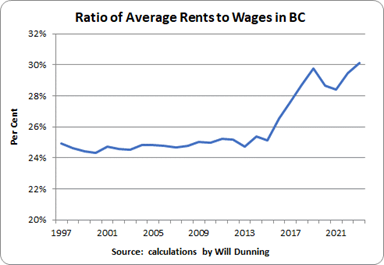

British Columbia’s vacancy rate (for apartments and town homes) decreased slightly during 2023, to 1.2 per cent versus 1.3 per cent a year earlier. Statistical analysis for B.C. indicates that the “balanced market” vacancy rate is about three to 3.5 per cent. With the current vacancy rate far below this, the market is highly pressured. Rapid population growth (3.3 per cent during the past year, versus a long-term average of 1.5 per cent) continues to exert pressure on the housing market.

CMHC estimates that rents increased by 9.2 per cent in 2023. The average rent (for all unit types) was $1,660. With actual vacancies far below the balanced market threshold for most of the past decade, rents have increased substantially in real terms and relative to incomes. While the provincial government has plans to push increases in housing construction aggressively, rental market pressures will not drop for some time.

For Vancouver CMA, the 2023 vacancy rate was 0.9 per cent and the estimated constant sample rent increase was 9.5 per cent. The average rent (for all unit types) was $1,828. For Victoria CMA, the vacancy rate was 1.6 per cent and the rent increase was 7.8 per cent. The average rent was $1,571.