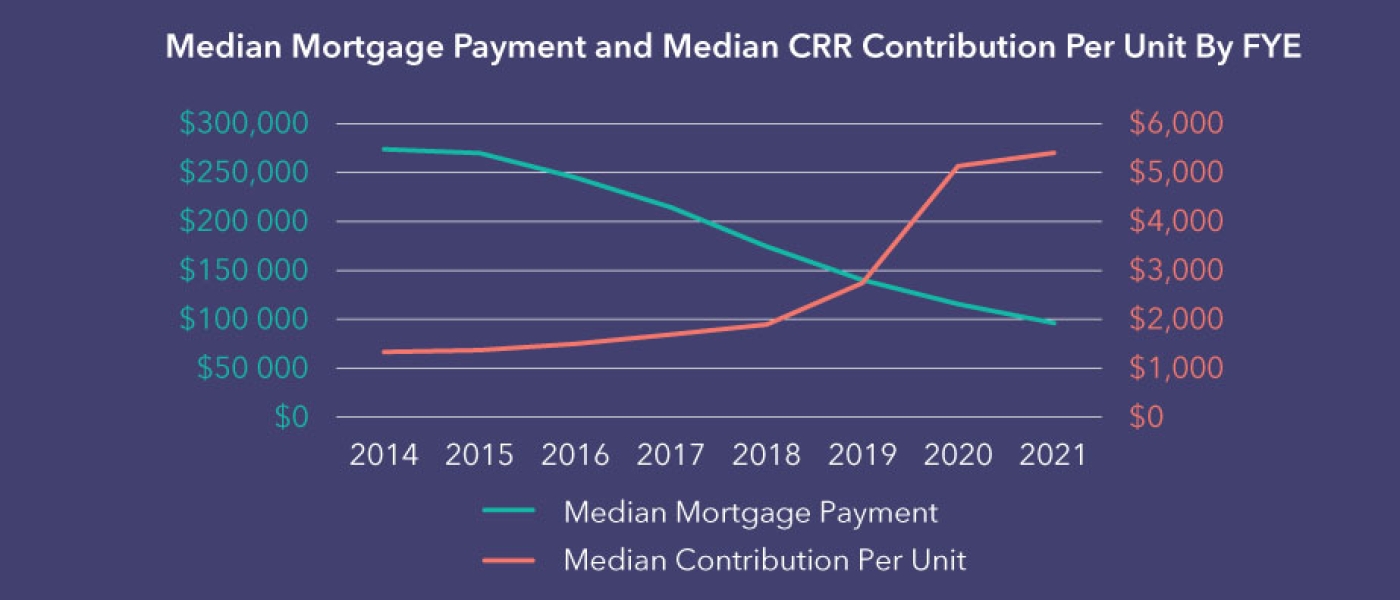

Many co-ops in the Agency’s portfolio reached an important milestone in the past several years: finally paying off their mortgages. For many, that has opened wide new worlds of financial freedom. And the good news is that many co-ops are using that freedom to top up their capital reserves.

As you can see, the data show that as mortgage payments have shrunk, many co-ops have been setting aside ever-greater amounts in their reserves, resulting in a corresponding increase in the median contribution per unit in capital reserves across the Agency’s portfolio of housing co-ops.

Everyone knows the importance of keeping up with contributions to capital-replacement reserves. A well-funded reserve ensures that your co-op has enough money to replace roofs, windows, appliances and other expensive components as they wear out. It also means that when the time comes to spend on capital replacements, you aren’t hit with spikes in your housing charges.

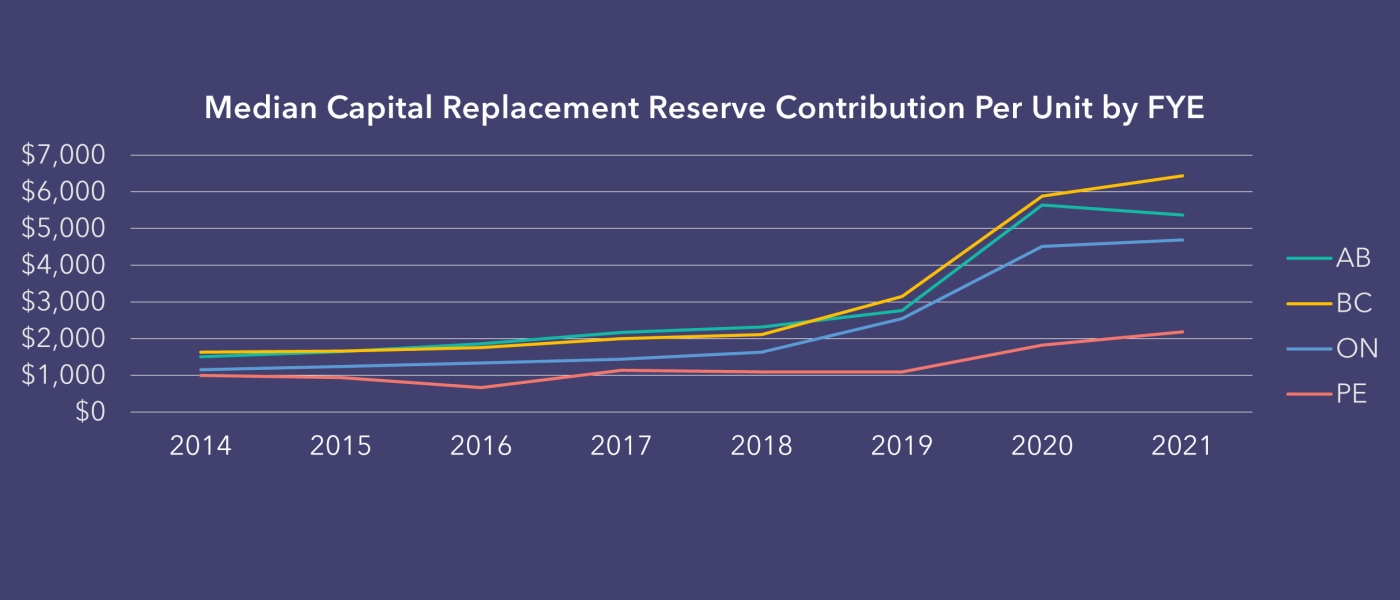

Encouragingly, we see these contributions increasing in each province in our portfolio. In 2014, the median contribution for Ontario was $1,150 per unit. By 2021, this had increased to nearly $4,700. In B.C., the median grew from just over $1,600 to over $6,400 per unit, and in Alberta, from $1,505 to more than $5,000 per unit. While the rise was smaller in PEI ($933 in 2014 to $2,182 in 2021), this is likely because many co-operatives in this province have not yet repaid their mortgages.

A final point about your capital-replacement reserves is the importance of an up-to-date building condition assessment (BCA). Co-op buildings are older (many reaching the 40-year mark), and in a post-pandemic world with high levels of inflation, you’ll want to know what will need to be replaced when, as well as roughly how much repairs are going to cost. We’ve put together a guide on BCA and reserve fund studies to help you navigate the process.

Want to learn more about capital replacement-reserve contributions? Check out some of the resources we’ve collected from CHF Canada, CMHC and others.